Neither account charges for basic banking features, although you'll pay fees in other ways.

#Bitsafe iban free#

On the other hand, Revolut allows you to top up your account with a bank transfer, debit card or credit card, which is more convenient, in our opinion.Īs mentioned, both N26 and Revolut provide generous features in their free plans, although the exact features of these plans may vary slightly depending on the country in which you’re using them. With N26, you can only top up your account through a bank transfer or by making a cash deposit using ia CASH26 (however the latter service is only available in Germany, Austria, Spain, Italy, and Greece). This includes savings accounts and overdrafts in Germany and Austria and direct debits (though Revolut offer does direct debits in both Euros and pounds). N26 offers a few features that Revolut doesn't have. If you’re from Poland or Norway, Revolut is therefore a better choice than N26, which only currently offers accounts Euros for EU/EEA residents (even in those countries that use a different currency). Revolut can provide unique local accounts details in pounds (if you're a UK resident), Euros (if you're a resident in a country within the Eurozone), krone (if you're a resident of Norway) and złoty (if you're a Polish resident), as well as other account details. Revolut offers more local currency options than N26. Local Accounts Details and Balance in Specific Currencies In terms of banking experience, we think N26 has a slight edge. N26 allows you to manage your account through both their smartphone app and via an online banking portal, whereas Revolut’s service is only available through the app, and you’ll need to reinstall to a new phone if you lose your old device. Revolut is slightly more limited as it’s effectively a prepaid card that gives you multiple currency options and lets you send money overseas quickly and easily.

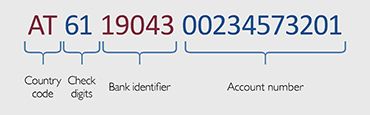

They offer features like overdrafts, interest on savings accounts and other functionality designed to make it easy to manage your money. N26 is focused squarely on providing a good alternative to the traditional bank account. N26 and Revolut have taken different approaches to the banking experience: Both banks also offer virtual cards in the app over and above the physical debit cards. Additionally, both providers let you easily block your debit card from their mobile apps if your card is lost or stolen. That’s why we’d recommend N26 over Revolut if you travel extensively.īoth providers offer elegant cards with a modern aesthetic, with metal cards available on their most exclusive plans. There’s one important difference though - N26 doesn’t charge commission on card transactions in a foreign currency, whereas Revolut charges up to 2% of the amount you spend. They both offer a Mastercard (though Revolut offers Visa cards in some countries) that supports contactless, Apple Pay, and Google Pay payments. On the surface, N26's and Revolut's debit cards are quite similar. As a result, if you're looking for more advanced banking features, then N26 has the edge. Additionally - although it's a licensed bank - Revolut's primary offering is still its prepaid, multi-currency card, and we think its banking services still have a way to go to becoming a more complete and mature product. Revolut may charge for faster transfers or to accounts that are not held with Revolut, while N26 doesn't charge for these services. Signing up for either N26 or Revolut will give you a current account (with an IBAN), a debit card, push notifications, budgeting, financial planning, money transfers, and several other core services. That out the way, let's get straight to our in-depth comparison of N26 and Revolut: ― Furthermore, in this review, we only compare the services' standard plans - namely the 'N26 Standard' and 'Revolut Standard' accounts respectively.

N26 is a fully-featured bank account, whereas Revolut's main offering is its prepaid debit card and multi-currency functionality (although a licensed bank, its banking services are still slightly less specialised and fine-tuned than N26's). It's important to note at the very beginning that N26 and Revolut are fundamentally quite different. Read on to see how they stack up with each other across multiple areas, including fees, product quality, and customer satisfaction. In this side-by-side review, we compare N26 and Revolut to help you make a more informed decision about the two.

Two of Europe's best-known fintechs, N26 and Revolut are two world-class digital banking services that both go a long way in reducing the costs traditionally associated with banking and offer a user-friendly online experience.

0 kommentar(er)

0 kommentar(er)